#Annuity online calculator plus#

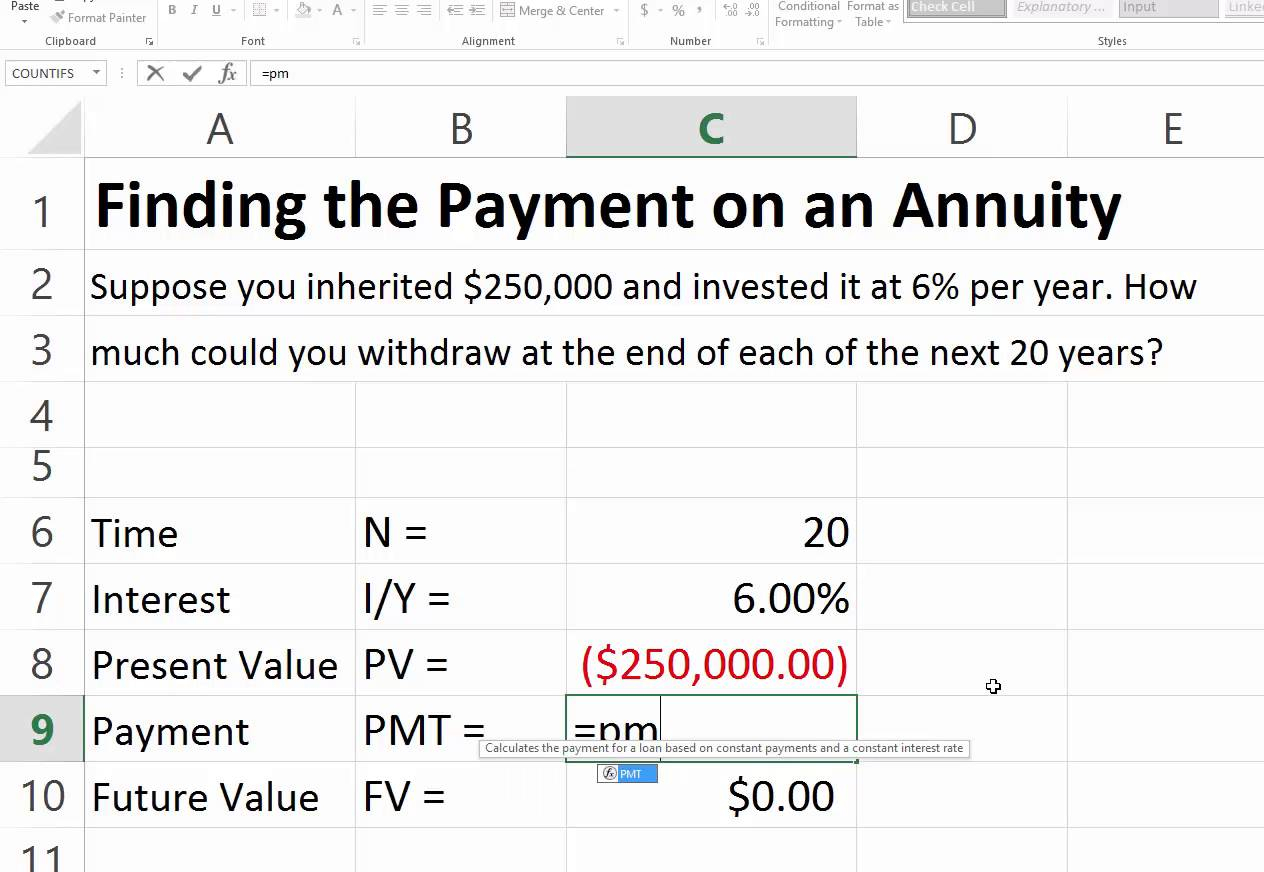

Present Value PV The result of the PV calculation is the present value of any future value sum plus future cash flows or annuity payments Select beginning for payments at the beginning of the period.Select end which is an ordinary annuity for payments at the end of the period.

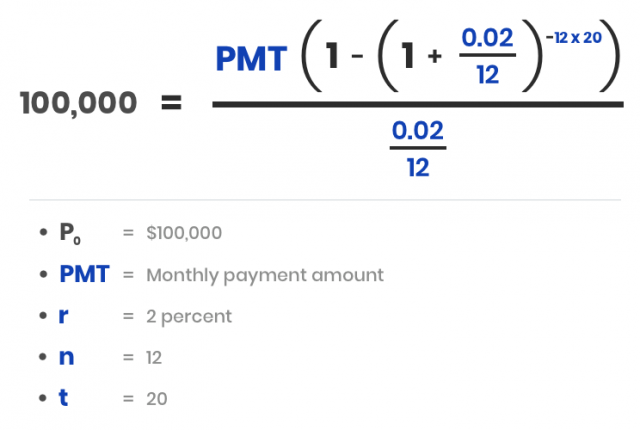

Enter 1 for annual payments which is once per year.Enter c or continuous for continuous compoundingĬash flow annuity payments going out PMT The payment amount each period Growth rate G The growth rate of annuity payments per period entered as a percentage Number of payments q per period.Enter 1 for annual compounding which is once per year.The number of times compounding occurs per period.Enter p or perpetuity for a perpetual annuity Interest Rate R The nominal interest rate or stated rate, as a percentage Compounding m.Be sure all your inputs use the same time period unit (years, months, etc.).Time periods is typically a number of years.The present value calculator uses the following to find the present value PV of a future sum plus interest, minus cash flow payments: Future Value FV Future value of a sum of money Number of time periods t Present value calculators offer more specialized present value calculations. You can enter 0 for any variable you'd like to exclude when using this calculator. The present value is the amount you would need to invest now, at a known interest and compounding rate, so that you have a specific amount of money at a specific point in the future.

The present value of an amount of money is worth more in the future when it is invested and earns interest.

The present value calculator answers the question, "What do I need to invest today to have a specific sum of money at a future date?" Find the present value of a future sum of money.

0 kommentar(er)

0 kommentar(er)